Just how a keen FHA financial works for basic-go out homebuyers

A keen FHA mortgage the most popular basic-go out homebuyer programs available. Whenever you are you’ll find advantages and disadvantages to each and every sort of mortgage, an FHA mortgage having very first-go out homeowners is usually the best option of these trying get into the fresh housing industry. If you are considering obtaining a keen FHA mortgage, you’ll know the way they works and exactly how you can be considered as the a first-time buyer.

FHA fund are offered of the old-fashioned mortgage lenders, however, these are generally supported by the us government. Once the government offers loan providers additional shelter in these mortgage loans, he or she is more likely to approve consumers with minimal credit score, low income, or minimal down payment loans. In a nutshell: These types of mortgage loans are usually easier to qualify for.FHA loans give a lot more incentives to your borrowers, as well. Including, FHA loans to have basic-go out homebuyers normally have lower rates of interest and require reduced down repayments. Maximum financial worth to own FHA funds varies from seasons in order to 12 months. In the 2022, the maximum financing to possess an individual-family home inside the a decreased-costs town is actually $420,680. The maximum mortgage having an individual-home when you look at the a leading-costs town is $970,800. The FHA along with set maximums for duplexes, triplexes, and you can five-plexes.

Benefits of an FHA financial to have very first-day homeowners

The reduced down-payment requirement is perhaps the largest benefit of a keen FHA mortgage to own first-day homebuyers. Protecting right up into the old-fashioned 20% downpayment can feel impossible when a whole lot of one’s money goes to your lease or other expenditures. FHA loans enable it to be individuals to pick a home which have a significantly significantly more doable down-payment, which makes owning a home more open to those with a modest earnings.FHA finance are also common having basic-date buyers as you won’t need to enjoys a borrowing from the bank get. As the finance are created to have earliest-day residents just who may not have a long credit score, you’ll be recognized having a credit history as low as five hundred.Interest rates usually are all the way down to possess FHA mortgages, as well. Securing for the a low-value interest at the beginning of your own loan will save you thousands of dollars through the years.

Drawbacks off an FHA home loan to have first-time homebuyers

The main disadvantage off a keen FHA loan to have a first-day homebuyer would be the fact you will need to shell out individual home loan insurance. Home loan insurance rates covers both you and your lender in the event you wade underwater to your loan, that is more likely to occurs once you build a tiny down payment. Others drawback to presenting an enthusiastic FHA mortgage is the fact providers sometimes like buyers who possess a conventional financial. Because the requirements getting FHA loans is less restrictive, the seller you are going to proper care that you will be unable to follow-up toward revenue. Whenever they discovered several also provides, they might purchase the consumer that have a traditional financial across the person with an enthusiastic FHA financing.

Simple tips to be considered because the a primary-go out homebuyer

Qualifying to have an enthusiastic FHA mortgage as a first-big date consumer is normally simpler than being qualified to own a traditional financial. Just like the FHA funds are created for brand new residents, the requirements to have credit history, income, and down payment be lenient. Minimal credit rating be acknowledged having a keen FHA loan given that a first-big date homebuyer with a great 3.5% down payment are 580. If for example the credit score are between five-hundred and you may 580, you will likely become approved to own a keen FHA home loan that have a beneficial ten% deposit. Debt-to-earnings proportion is an additional trick degree for a keen FHA loan to possess first-go out homebuyers. This is basically the percentage of the pre-tax income you to would go to your own homes repayments and other costs. The debt-to-earnings ratio constraints for FHA money differ based on their borrowing from the bank record, but the restrict your FHA always approves was 50%.

Getting approved getting a keen FHA mortgage while the an initial-big date homebuyer

Trying loans in Black to get an FHA loan given that a primary-big date homebuyer are going to be a lengthy procedure. Listed here are half a dozen methods you will want to expect you’ll complete:

step one. Make sure to qualify.

You will have a thorough knowledge of your finances before you get a keen FHA home loan. Pick would be to look at the credit history and estimate the debt-to-money ratio so that you can submit an application for the borrowed funds that have depend on.

dos. Rating pre-accepted.

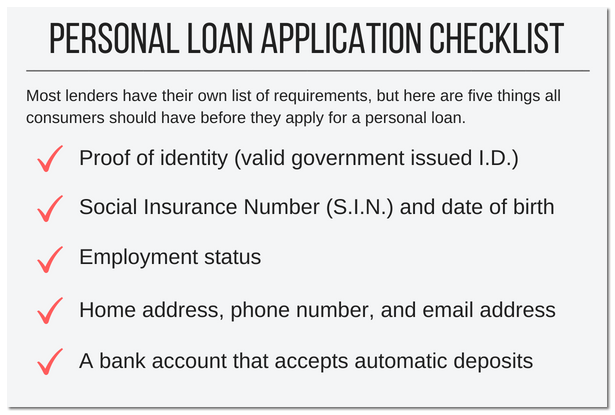

Trying to get pre-acceptance for a keen FHA financing because the an initial-big date homebuyer isnt a requirement, nonetheless it streamlines the procedure helping your put a funds before you can take a look at homespleting the official software will also be smoother if you have gotten pre-recognition.You will need to bring a wide variety of records you to establish your revenue, bills, and other monetary affairs. Here are the secret items of advice you will want to gather:

step three. Apply for the mortgage.

When your provide to the a home has been accepted, you can submit the state app to suit your mortgage. If you are pre-recognized with your lender, they are going to already have the necessary monetary data files, therefore implementing are simple. For individuals who haven’t been pre-approved, you’ll have to assemble debt suggestions during this period.

4. Experience the brand new evaluation and assessment.

Before you could romantic on home, you’re going to have to over an enthusiastic FHA review and you can appraisal. The intention of the new review is to make sure the assets meets safe practices requirements. The goal of the latest appraisal will be to ensure that the household is basically worth everything you intend to shell out.

5plete the brand new underwriting techniques.

The latest underwriter for your mortgage will learn debt history, money, and you can credit history to make sure you can handle this new monthly mortgage repayments. Loan providers will always be getting a danger after they mortgage currency, however the underwriting techniques gives them a lot more believe in your ability to settle the debt.

6. Close towards the home.

When you have come recognized for the FHA mortgage and also finished all original measures, you could potentially fundamentally personal on your own very first family. Throughout your closing, you are going to need to pay multiple will set you back, and additionally charges towards appraisal, underwriting, label browse, and you can loan running. You might shell out this type of charges with your own money otherwise roll them into the financial.

Working with a loan provider your faith

An enthusiastic FHA financing getting very first-time homebuyers renders homeownership a lot more accessible to you. The newest down payment criteria are minimal versus antique funds, and rates of interest usually are a whole lot more competitive. Whenever you are preparing to get your first domestic, you need to cautiously research your options to own FHA fund while the a great first-date buyer.