How exactly to Acquire of an effective 401k? | 401k Financing

A beneficial 401(k) advancing years package try a powerful equipment to own building your financial coming. Provided by of several employers in america, it allows that save your self having later years through benefits myself from your own paycheck ahead of fees is actually computed. It lowers your current taxable income, and your currency increases tax-deferred into the account. Ideally, a great 401(k) is intended to bring income using your senior years decades.

Yet not, lifestyle is also toss unanticipated curveballs. Certain 401(k) preparations offer the substitute for borrow on your spared financing. That is appealing in the face of emergencies or biggest expenses such scientific costs, house fixes, if you don’t a deposit to the a property.

It is important to understand that credit from your 401(k) is reached which have care. Consider it once the a last hotel, maybe not a handy solution to simply take more cash. When you are you will find benefits to 401(k) money, it’s vital to understand the possibility downsides and how they might affect your own much time-title economic shelter.

Why does a 401(k) Mortgage Functions?

- Eligibility: Start by targeting not most of the 401k preparations allow it to be finance. It’s important to look at your specific plan’s rules with your administrator or Hours service.

- Financing Restrictions: Determine there are constraints with the borrowing from the bank count. Generally, you might borrow up to 50% of the vested balance (the latest bit you to definitely totally belongs to you) otherwise $fifty,000, any type of is reduced.

- Interest levels: Say that when you find yourself 401(k) loan rates vary by plan, they’ve been fundamentally as good as signature loans. The key improvement is the fact you will be essentially paying interest so you’re able to oneself, Wisconsin loans because the that money goes back into your advancing years membership.

- Cost Words: Very agreements require you to pay-off the borrowed funds in this 5 years. Payroll write-offs could be the most commonly known payment method, ensuring constant and you can automated improvements.

Example: Assume the vested 401(k) balance try $sixty,000. You can acquire around $29,000 (50%). You’d then pay-off it, in addition to attract, more than a four-season months due to deductions out of your paychecks.

Benefits associated with a great 401k Loan

- Accessibility: In place of antique loans from banks, qualifying for a good 401(k) mortgage is fairly easy. There’s no credit assessment on it, since the you might be fundamentally credit from your money.

- Straight down Notice: Most of the time, the eye costs to the 401(k) loans is rather less than personal loans or mastercard prices. This will trigger good discounts along side life of the brand new loan.

- Zero Credit Feeling: While the 401(k) loans aren’t stated so you can credit agencies, they don’t affect your credit rating. This really is specifically helpful if you are planning and make a primary purchase, such a property, in the future.

- Convenience: The latest fees techniques can often be streamlined by way of automated payroll deductions. So it eliminates the dilemma from a lot more costs and you can guarantees uniform cost improvements.

Note: It is worthy of highlighting that since the attract you only pay goes back into the 401(k), there is certainly nonetheless the possibility cost of lost prospective industry gains during the time those funds is beyond your bank account.

Dangers of 401(k) Financing

- Shorter Later years Coupons: This is probably the greatest risk. Once you use from your 401(k), your lose out on the efficacy of substance attract. The cash taken no longer is working out for you, possibly ultimately causing a smaller sized nest egg into the retirement.

Example: Assume you’re taking a $ten,000 401(k) mortgage and you will miss out on the average 7% annual come back over 5 years. Your possibly miss out on more than $cuatro,000 into the progress you’d keeps if you don’t got.

When do a good 401k Financing Sound right?

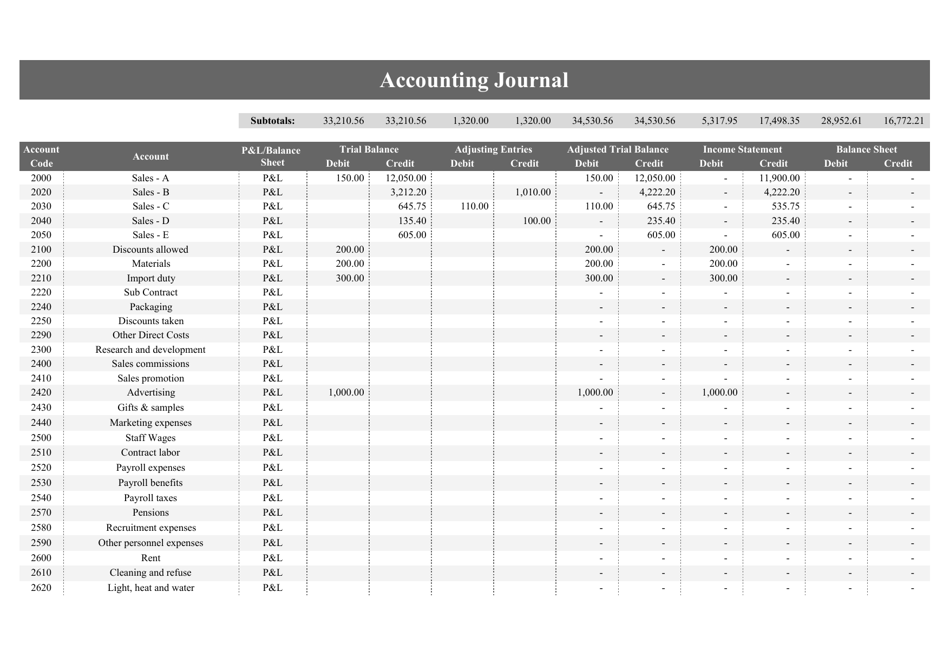

Inspite of the threats, there are certain situations where an excellent 401(k) loan might possibly be a good choice to a monetary challenge. We have found a table to help you instruct potential issues, also notes to consider:

Just think about this in case the 401(k) mortgage rate of interest is a lot below the eye with the existing debt; otherwise, the dangers on the senior years almost certainly outweigh the huge benefits.

Note: Even in these situations, an effective 401(k) loan can be a carefully thought decision. Its basically advisable to discuss choice very first, eg building an urgent situation funds.

Possibilities to 401k Funds

Note: It certainly is smart to evaluate the genuine will cost you of each option, and interest rates, payment timelines, and you may possible influence on their long-title financial desires, before deciding in the event the an excellent 401(k) loan ‘s the proper choices.

End

Credit from your own 401(k) will be a feasible choice for real issues otherwise high opportunities particularly a house. The low interest levels and you will sleek repayment was experts. However, it’s vital to consider this isn’t totally free currency. The newest impact on retirement discounts should be cautiously believed, and possibility of taxation and you will penalties for individuals who leave your job. Constantly weighing the risks thoroughly just before experiencing retirement funds. Seeing a financial elite group can help you explore your choice and come up with an educated choice for the financial upcoming.

Note: The information provided is actually acquired regarding individuals other sites and you may collected data; when the inaccuracies try known, please contact you by way of statements to have quick correction.